How to Prepare Your Homemade Jam for Sale

November 11, 2023

Why It’s Time to Convert from QuickBooks Desktop to QuickBooks Online

February 5, 2024

How to Prepare Your Homemade Jam for Sale

November 11, 2023

Why It’s Time to Convert from QuickBooks Desktop to QuickBooks Online

February 5, 2024December 22, 2023

Understanding Your Gross Margins

By Evan Driscoll, Senior Business Consultant

This blog post is the first in a two-part series about gross margins. In this post, we share why tracking your direct-to-consumer gross margins matters and how to track them in a meaningful way. In our upcoming second blog post, we’ll share six tips to improve your gross margins for sustained profitability.

What are Gross Margins, and Why Do They Matter?

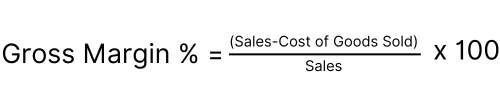

Gross margin is a percentage that represents the difference between sales and the cost of goods sold (COGS) divided by sales. It specifically measures how efficiently a business produces and sells its products.

The engine of profitability

Gross margins serve as the engine that propels your business towards profitability. A healthy gross margin ensures that each sale contributes positively to your overall profitability.

The first line of defense against losing money

Gross margins act as the initial defense mechanism, shielding your business from potential financial losses. By evaluating the profitability of individual products or services, you can identify areas where costs may be eroding your profitability. This early detection gives you time to make strategic adjustments in order to maintain a healthy bottom line.

Potential for losses with low gross margins

If your gross margin is too low, a counterintuitive situation may arise: the more of a particular product or service you sell, the more money you stand to lose. Low gross margins can undermine your efforts to scale, as increased sales may not translate to increased profitability. It highlights the importance of ensuring that each sale contributes positively to your financial success.

Focusing on profitability by enterprise

For businesses with multiple enterprises, pinpointing areas that may not be as profitable as desired is crucial. Examining gross margins by department within a specific enterprise serves as an excellent starting point for strategic intervention. For example, you might own an apple farm that makes apple cider. In this instance, you would have two enterprises: 1) a farm that produces apples, and 2) a processor that produces apple cider. These enterprises both have vastly different ways in which they generate revenue, costs, and profits, and understanding if and how each of these enterprises generates profits is critical to your overall business success.

The Common Culprit for Meaningless Margins: Inventory Changes

If you produce a salable item that you hold for more than 30 days before selling, then you have inventory that needs to be managed. Inventory is the number one reason we see that creates meaningless gross margins. As you accrue inventory, you accrue costs, but not sales, which is detrimental to your gross margins. Accounting for the value of this inventory in your financial statements will allow you to see your true gross margins, and manage to them accordingly. Accurately calculating gross margins depends on you tracking your inventory changes accurately. Take a look at the following example:

- Sold $10,000 of Apple Cider in 2019

- Bought 1,000 gallons of cider in October 2019 @ $3.00/gallon and froze it for 2020 = $3,000 of Cider COGS in October

- Spent a total of $9,000 in 2019 on Apple Cider

- Gross Profit = $10,000 revenue – $9,000 in COGS = $1,000

Gross Profit = 10% Gross Margin

The correct way to adjust for inventory changes:

- Jan 1, 2019: Cider Inventory = $100

- Dec 31, 2019: Cider Inventory = $3,000 (cost value)

- Cider Inventory INCREASED by $2,900

- Make a journal entry to Increase Cider Inventory by $2,900 on the Balance Sheet and DECREASE Cider COGS by the same amount.

- Now sales are still $10,000, but COGS (on an accrual basis) have decreased from $9,000 to $6,100.

- Gross Profit = $10,000 revenue – $6,100 COGS = $3,900

Gross Profit = 39% Gross Margin

Why Use the Accrual Method?

Accrual accounting is a method that records revenue and expenses when they are incurred, no matter when cash actually changes hands. This approach involves tracking payables and receivables, offering a more comprehensive view of your financial position. It becomes particularly necessary when dealing with transactions on credit terms, whether involving suppliers or customers. If you sell cider to a wholesale business, they might have payment terms of 30 – 90 days. We want to recognize that cider sale when the product is delivered, rather than when the payment is actually received, so that this revenue is aligned with the costs associated with it (production costs, sales/marketing costs, delivery costs, etc.). Aligning sales with costs is what results in accurate gross margins, and gives you the information you need to make better decisions to meet your profitability goals.

By recognizing economic activities as they occur, accrual accounting provides a clear picture of both your sales trends and your financial health.

Now I Know My Gross Margins. So What?

Now that you can clearly see and understand your gross margins, you can start to utilize it as a management tool.

- Create Your Gross Margin Goal: Create a budget that includes what your gross margin should actually be. This gross margin becomes your target to shoot for. These gross margin goals should support a strong net profit goal (ie. the bottom line)

- Build Your Gross Margin Review Process: Now that you have a budget, upload this budget to your accounting system (ie. Quickbooks Online). You will then be able to run Budget vs. Actual reports, and measure in real-time if you’re hitting your gross margin targets.

- Make Time For Gross Margin Review: On at least a monthly basis, run reports, calculate your gross margins, and ask yourself “Why am I, or am I not, hitting my gross margin target?” If your gross margin is low, then you need to dig into why this is. Did our suppliers increase their prices? Did our labor costs increase? Are we producing product less efficiently? These questions that arise direct your focus – one of your business’s most valuable assets.

Stay tuned for part two of this series, “6 Ways to Improve Your Gross Margins”