Stand Out This Holiday Season: 6 Strategies For Farms & Food Businesses

November 1, 2024

Take Control of Your Cash: Simple Steps to Manage Your Money Like a Pro

January 20, 2025

Stand Out This Holiday Season: 6 Strategies For Farms & Food Businesses

November 1, 2024

Take Control of Your Cash: Simple Steps to Manage Your Money Like a Pro

January 20, 2025January 19, 2025

How to Build a Budget for Your Farm or Food Business

By Grace Debbeler, Business Consultant

Building a budget is a critical step in achieving your sales goals. Whether you’re starting a new operation or continuing an existing one, a budget helps compare your actual sales to your projections. This comparison helps you determine whether you’re successful according to your plan. With a budget, you can drive revenue by focusing on what’s increasing profitability and identifying what’s bringing down profit.

The budgeting process also gets you into the routine of managing your business outside of selling and paying bills. By budgeting every year, you create valuable historical records. These records benchmark against your past performance and plan for your business’s future potential.

Budget Building Overview

Understand the Structure and Process

Our budgeting process follows our COA (Chart of Accounts) structure, where we list income and expenses by product category. This helps us determine profitability by product category and create accurate historical records for year-over-year comparison. You can learn more about how we structure the Chart of Accounts for our clients and get our free COA template here.

For example, we’d group income by product categories such as vegetables, dairy, or turkey, instead of by sales channels like farmers’ markets, farm stands, or direct-to-consumer sales. It’s easy to see sales by sales channel with customized reports in Quickbooks. This method helps us determine profitability by product category. Associated with each product is its related cost of goods sold account (COGs), which are the direct costs of the product category.

Start with Income and Expense Accounts

We use seven main categories for income and expenses to help with budgeting and understanding how expenses relate to sales.

1. Income: Money received from selling your products or services.

2. Cost of Goods Sold (COGs): Direct costs related to the income product category, like seeds for vegetables. For example, if you want to increase the amount of broccoli you grow, you will need to increase the number of seeds you purchase. There are other associated costs with increasing production but if they don’t have a direct relationship with sales, we typically see those expenses in operating expenses.

3. Labor: All labor costs, including the owner’s labor, payroll, and benefits. This helps in understanding the true cost of running your operation.

4. General & Admin: Business administration expenses that are discretionary and budgetable, like office supplies. The owner can decide how much they spend on marketing, versus fixed costs which have little wiggle room.

5. Operating Expenses: Costs that vary with sales, like repairs and maintenance, but aren’t linked to a specific product. These are often around 40% of total sales for vegetable production operations, covering expenses like fuel, repairs, and maintenance.

6. Fixed Expenses: Costs that remain constant, like rent and loan interest rates, regardless of your sales volume.

7. One-Time Expenses: Large, non-recurring expenses, often for equipment or investments in the business.

Be a savvy business owner.

Get tips on accounting, finance, marketing, and more, tailored for farms and food businesses—free.

"*" indicates required fields

Review Key Metrics

To review your financial health, start with your income, followed by COGs. Subtracting COGs from income gives you the gross profit (or gross margin, which is gross profit divided by total revenue). This figure should be positive and sufficient to cover all overhead expenses.

Subtract overhead expenses (operating, labor, general and admin, fixed, and one-time) from the gross profit to determine your net profit.

The net profit is the amount of money left at the end of the year, and ideally, this should also be positive.

Step-by-Step Guide For Building a Budget

1. Make Sales & Labor Projections

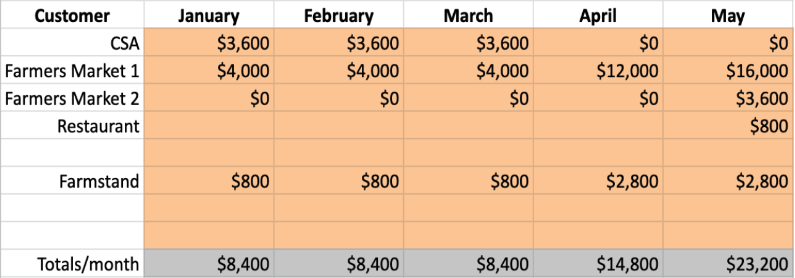

When starting the budgeting process, focus on income and labor, as they are usually directly related and the most significant expenses for production farms. Build out a monthly projection for the next year. List your sales channels, like farmers markets, farm stands, wholesale, or DTC business, and project sales by month for each category.

Sales projections (by customer and by month)

Sales Projections

Historical data is key for making accurate projections. If starting a new enterprise, make educated guesses based on similar past experiences. For example, if you plan to start a DTC business with turkeys in October, estimate the number of customers and the price per turkey to project income. If you hope to sell 50 turkeys at $30/turkey, that would mean $1500 in projected turkey sales.

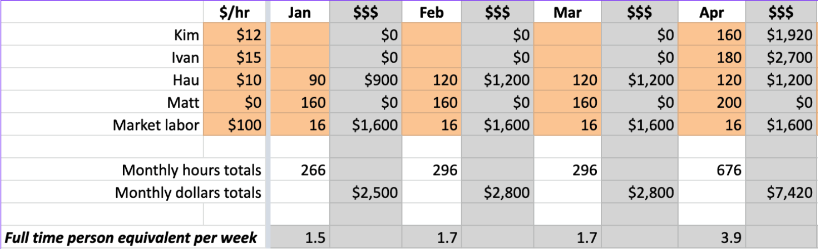

Labor Projections

Next, project your labor needs by listing everyone who works for you, their hourly rates, and the estimated hours per month they will work. Compare your labor projections to your sales projections to ensure labor costs are manageable. Consider seasonal changes, like more labor in the spring for planting and higher income in the fall during harvest.

Labor projections (laborer, rate, hours per month)

2. Organize Accounts and Drivers

Begin by listing all your accounts. If you don't already have a template, use our suggested categories.

Label each row by its driver—what drives these expenses? For example, sales projections drive income and labor. Operating expenses can be considered a percentage of sales, typically around 40% for farms. General and admin expenses are budgeted amounts, and fixed expenses are known constants.

3. Total Each Category

Finally, total each category: total income, total COGs, total labor, total operating expenses, total general and admin, and total one-time expenses. This gives a clear picture of your financial health and helps with planning for profitability and growth.

Our Suggested Categories List:

- Income by product category

- Cost of Goods Sold (COGs) accounts directly related to product categories

- Overhead expense accounts, categorized under:

- Fixed

- General and admin

- Operating

- Labor

- One-time expenses

Following these steps will help you build an effective budget, ensuring your farm or food business stays financially healthy and profitable. If you need help getting started or would like a consultation for budget building, just reach out!